|

|

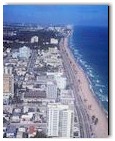

Welcome to the Greater Fort Lauderdale

Area

Fort Lauderdale

and all of Broward County, plus southern Palm Beach

County

,

is our specialty. Our site is designed exclusively to help you,

the homebuyer, make an intelligent home buying decision and to help you

learn your legal rights when buying a home in the greater Fort Lauderdale area.

Search everything the web has to offer, right here! As Exclusive

Buyers Agents, we want you to have the most comprehensive and

up-to-date information available.

Fort Lauderdale

and all of Broward County, plus southern Palm Beach

County

,

is our specialty. Our site is designed exclusively to help you,

the homebuyer, make an intelligent home buying decision and to help you

learn your legal rights when buying a home in the greater Fort Lauderdale area.

Search everything the web has to offer, right here! As Exclusive

Buyers Agents, we want you to have the most comprehensive and

up-to-date information available.

Need

local Ft. Lauderdale information?

Weve included everything in our

site we can think of that is important pertaining to the greater Fort Lauderdale

area real estate market.

Need expert advice? This site is filled with useful knowledge, plus

ways you can contact us for help and advice. Real estate in Fort

Lauderdale, the rest of Broward County, and Southern Palm Beach County,

is our passion and expertise! If there is specific real estate

information you need about the greater Fort Lauderdale area but cannot

find it here,

e-mail us

and we

will gladly answer any questions you may have with NO OBLIGATIONS.

Complete our brief questionnaire

and we will

send you our free relocation package, real estate listings, or any other

real estate information you need about the greater Fort Lauderdale area.

ways you can contact us for help and advice. Real estate in Fort

Lauderdale, the rest of Broward County, and Southern Palm Beach County,

is our passion and expertise! If there is specific real estate

information you need about the greater Fort Lauderdale area but cannot

find it here,

e-mail us

and we

will gladly answer any questions you may have with NO OBLIGATIONS.

Complete our brief questionnaire

and we will

send you our free relocation package, real estate listings, or any other

real estate information you need about the greater Fort Lauderdale area.

Contact us with confidence! We guarantee

your privacy

will be

respected. Wed like to be your

Exclusive Buyers Brokers

. As your

professional real estate partner, we will help you find the best home in

your area within your price range.

|